August-

September 2014

Family: It Matters

------------------

|

brown on green, A Regular column about finances

Risky Business

Risk is part of life. Learning to manage risk is what is important. What is the appropriate amount of risk to take in different situations? Determining the level of risk with which you are comfortable is the first step before setting up an investment account. This may sound like an easy process but it’s not.

Many people believe they have a high risk tolerance, but when the market “goes south,” they can’t take the risk and bail out. It is easy to say you have a high risk tolerance when you have just enjoyed five straight years of good returns in the stock market. But you have a high tolerance for risk if you can handle a 20% correction (or even worse, a 38.5% downturn like those experienced during the market meltdown in 2008) without panicking.

Historically, the stock market has been positive 76% of the time, but that means it is negative one in four years. The stock market never goes straight up without occasionally experiencing a serious downward correction.

Others have too low a risk tolerance and never get comfortable in the stock market. If your risk tolerance is this low, it will be difficult to meet long-term goals because your earnings rate will always be low.

Risk should be tempered by your particular investment goals. If you are saving for a relatively short-term goal (three to five years) you shouldn’t take a lot of risk. In a short-term window, you can’t afford to experience a significant downturn, as it will affect your overall earnings rate severely. Someone saving for retirement at a relatively young age should be willing to take more risk. Even if they encounter significant downturns, the overall

return will be good because they have

a longer time horizon.

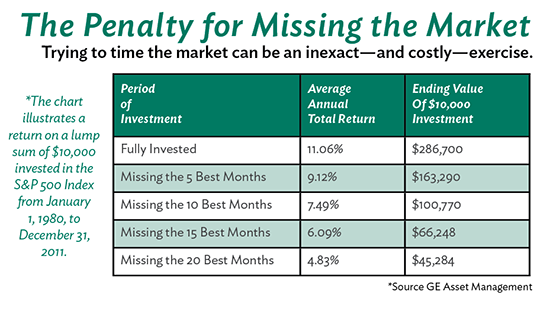

For a long-term investment, returns will be better for those who invest in a mixture of stocks and bonds. Many studies have confirmed that staying fully invested, even during downturns, will deliver the best return over time. Jumping out of investments and “cashing out” every time the market gets volatile leads to lower returns.

Sometimes, older investors get close to retirement and believe they need to take more risk to build their account faster. It’s very risky to do this, because if they experience only one bad year, they could lose money.

Generally, the shorter your time horizon, the less risk you should take. However, your own risk tolerance is important to consider as you invest as well. Consider your appetite for risk carefully before you invest.

David Brown, CPA, became director of the Free Will Baptist Foundation in 2007. Send your questions to David at david@nafwb.org. To learn how the Foundation can help you become a more effective giver, call 877-336-7575.

|

|