October-

November 2017

The Work Goes On

------------------

|

brown on green, A Regular column about finances

RMD - Required Minimum Distributions

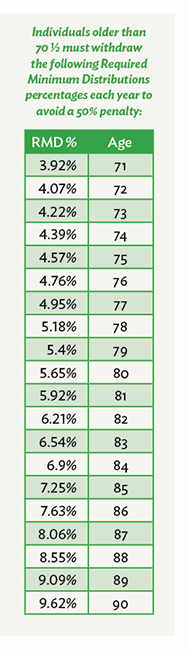

Older individuals are required to make required minimum distributions (RMD) from their IRA and other retirement plans in the year following the year they turn 70 ½ and every year after until their death. Anyone failing to make this distribution is hit with a 50% penalty. If you are required to withdraw $10,000 and fail to do so, the penalty is $5,000. The purpose of this requirement is the government wants you to expose these distributions to tax. Retirement plans (other than a Roth) accrue pre-taxed earnings in the plan, and individuals are allowed tax-free contributions.

Therefore, the IRS wants to collect on deferred tax revenue during retirement.

For many, this is no problem. They need to make distributions larger than their RMD anyway, just to have adequate retirement income. Some want to preserve as much as possible in their IRAs and retirement plans to pass on to their heirs. Unfortunately, even if it does pass to your children after you die, they also will have to pay tax on distributions.

Retirement accounts are one of the best choices to fund bequests from your estate. A charitable organization does not pay income tax. The process is simple and requires only that you change the beneficiary of your retirement plan.

One way to preserve the balance in your retirement account is by using dividend stock. During the early years of distribution, some of your RMD can be paid out as dividends, thus preserving a portion of the principal. Careful selection of dividend stocks that grow their dividend every year will allow this process to continue, even as the RMDs grow in your later years.

The top 50 dividend-paying stocks from the S & P 500 have been paying dividends for 25 or more years straight, and have increased their dividend every year. The average dividend yield on this group is around 2.5%, and the average increase in dividends each year is 5%. This means the 2.5% yield on the stock purchased today will be yielding over 6% in 20 years. (These stocks are used as an example and not necessarily being endorsed.)

This type of investing could be used to preserve the value of your IRA or retirement plan. Consider preserving your retirement assets and using them to make a bequest to endow a ministry.

About the Writer: David Brown, CPA, became director of the Free Will Baptist Foundation in 2007. Send your questions to David at david@nafwb.org. To learn how the Foundation can help you become a more effective giver, call 877-336-7575.

|

|