August-

September 2013

Do You Have

Sticky Faith?

------------------

|

Thinking About Opting Out of Social Security?

by Ray Lewis

During my early days with the Board of Retirement, our office frequently received calls seeking advice from ministers on opting out of paying Social Security. Our advice was always the same. “Think very carefully before making that decision!”

For a few years, the tendency to “opt out” seemed to die down—that is, until 2013 rolled around. Once again, there seems to be a push to encourage young ministers to exercise this right. I have already addressed this issue more this year than I have in the past few years put together.

Is it possible for a minister to opt out of paying Social Security or self-employment tax legally? Yes. Until 1968, ministers had the option of entering the Social Security system. Beginning in 1968, it became a requirement. However, the new requirements also made provision allowing a minister to opt out with respect “to services performed in the exercise of ministry” if they had valid reasons for doing so.

Revised Reasoning

We typically hear three main reasons for choosing to opt out. The first is, “Social Security benefits won’t be available when I retire.” This is followed by, “I can do a better job investing my money than the government,” and “It’s not the government’s job to take care of people.”

The problem is that in the eyes of the Social Security Administration, none of these are acceptable reasons for opting out of paying Social Security. The minister’s reasons for opting out cannot be based on personal or political views regarding government or the Social Security system. Objections for religious reasons must be the only governing principle used in this decision.

Forms and Facts

To opt out of Social Security, a minister must file Form 4361 within the first two years of entering the ministry. If you are considering the decision, obtain a copy of this form and read it. Don’t blindly accept the advice of others. Understand what you are signing and agreeing to. After reading the requirements, pray about the decision first, and then consult a tax professional who works with clergy before signing.

Before a minister signs and files Form 4361 with the IRS, certain requirements must be satisfied. When you sign the form, you certify “that I am conscientiously opposed to, or because of my religious principles I am opposed to, the acceptance (for services I perform as a minister...) of any public insurance that makes payments in the event of death, disability, old age, or retirement; or that makes payments toward the cost of, or provides services for, medical care.”

This statement indicates that you have an objection to receiving public insurance. It is not a statement about what you think about public insurance as a whole.

Also, the minister must certify that he has informed the licensing body of his church or denomination that he is opposed to the acceptance of public insurance benefits based on ministerial service on religious or conscientious grounds.

Let me encourage you to visit http://www.irs.gov/pub/irspdf/p517.pdf and print a copy of Publication 517. This document specifically deals with “Social Security and other information for the members of the clergy and religious workers.”

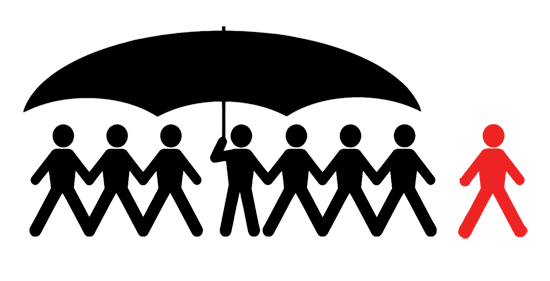

More Than a Check

For those considering the opt-out option, it is important to keep in mind that Social Security provides more benefits than just a retirement check each month. Social Security offers insurance and disability benefits as well. If a worker becomes disabled, Social Security benefits might be the only source of income he has. Social Security can also provide vital financial protection in unfortunate situations where the head of the household is killed or disabled.

If you opt out, several items need to be put in place to ensure that you and your family receive care:

Make sure you have sufficient term life insurance. Financial advisors recommend ten times the amount of your annual salary, especially if you have young children.

Make sure you have sufficient long-term disability insurance. If you become disabled after opting out, you will not receive anything from Social Security.

Open a retirement savings account like the 403(b) Plan offered by the Board of Retirement. You might also invest in a Roth IRA. It is important to start contributing early and be consistent because if you opt out of Social Security, this may be your main (or possibly your only) source of income during retirement years.

Secure long-term care insurance and health insurance coverage to take the place of Medicare because when you opt out of Social Security, you also opt out of Medicare.

If you’re willing to take responsibility for yourself by planning for retirement and having the proper insurance, opting out of Social Security could work for you. Through the years, however, I have talked to many men who opted out of Social Security while they were young, and realized they had not adequately prepared for retirement.

Think carefully before signing on the dotted line.

About the Writer: D. Ray Lewis joined the Free Will Baptist Board of Retirement in 1983. He became director in 2005 after serving for several years as assistant director.

|

|