brown on green, A Regular column about finances

by David Brown

IRA Giving

The Federal Government allows individuals to deduct tithes to their church as a charitable contribution on schedule A of their tax return. If your itemized deductions are over $11,400 (the standard deduction), you can use itemized deductions to save on your taxes. Many times a working couple who is buying a house and tithing to their church will far exceed the standard deduction.

The standard deduction for couples over 65 is $13,600. Many older couples cannot deduct their tithes as a charitable contribution because they will not meet this threshold. Retired couples will often have their house mortgage paid and so they lose one of the largest itemized deductions available to most working couples.

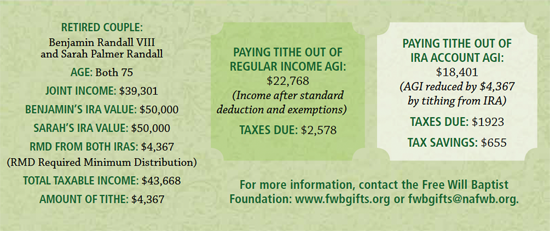

Fortunately, the recent tax cut plan Congress passed allows individuals over 70½ to make tax free transfers from their IRAs to charitable organizations. This makes it possible for senior individuals to get a tax benefit for charitable gifts. After 70½, individuals are required to take minimum distributions from IRAs, which are taxable income. Diverting this distribution to your church or other ministries will mean this transaction is not taxable.

Since you were going to tithe anyway, why not make the gift from your IRA instead of your checking account? Using this method will reduce your taxable income by the amount you have transferred to the ministry. For instance, a retired couple with a taxable income of $40,000 a year could transfer $4,000 from their IRAs to make the tithe they were intending to make and, at the same, time reduce their taxable income to $36,000.

The maximum amount that can be transferred is $100,000 and the distribution must come from an IRA. You cannot make transfers from other retirement plans like a 403b or 401k. This provision is temporary and will expire at the end of 2011 unless Congress acts to extend it.

Seniors 70.5 years and above should take advantage of this law and act now to give generously. You may be able to give more using this method since you are reducing your taxable income. You can give to your local church or to a national ministry. Consider a gift to your local church or a national ministry. The World Missions Offering is in April!

|